How a 0.5% Fed Rate Hike Impacts US Mortgage Rates

Anúncios

A 0.5% interest rate hike by the Federal Reserve can directly influence mortgage rates in the US, potentially increasing the cost of borrowing for homebuyers and impacting affordability.

The Federal Reserve’s monetary policy decisions often send ripples throughout the financial world. A key area affected is the mortgage market. Understanding what a Federal Reserve’s Anticipated Interest Rate Hike of 0.5% Mean for Mortgage Rates? is crucial for anyone looking to buy a home or refinance their existing mortgage.

Anúncios

Understanding the Federal Reserve’s Role

The Federal Reserve, often called the Fed, is the central bank of the United States. It plays a vital role in shaping the nation’s economic policy. One of its primary tools is the federal funds rate, which influences the interest rates that banks charge each other for overnight lending.

What is the Federal Funds Rate?

The federal funds rate is the target range set by the Federal Open Market Committee (FOMC). This rate doesn’t directly dictate mortgage rates but significantly influences them.

Anúncios

How Does the Fed Influence Interest Rates?

The Fed influences interest rates through various mechanisms, including open market operations and setting the discount rate, which is the rate at which commercial banks can borrow money directly from the Fed.

- Changes in the federal funds rate can impact short-term interest rates more directly.

- Longer-term rates, such as those for mortgages, are affected by expectations of future Fed policy.

- Market participants anticipate how the Fed’s actions will influence inflation and economic growth.

The Fed’s decisions are based on its dual mandate: to promote maximum employment and stable prices. When inflation rises above the Fed’s target of 2%, it often responds by raising the federal funds rate.

In conclusion, the Federal Reserve’s influence on interest rates is substantial. A clear understanding of its mechanisms helps in anticipating the impact on mortgage rates.

The Immediate Impact on Mortgage Rates

When the Federal Reserve announces an interest rate hike, it immediately raises questions about the real-time implications for mortgage rates. The correlation is complex, but perceptible changes often follow.

Initial Market Reactions

The bond market, particularly the yield on 10-year Treasury notes, tends to react swiftly to Fed announcements. Mortgage rates often track the movement of these yields.

How Lenders Respond

Mortgage lenders typically adjust their rates to reflect the new economic landscape created by the Fed’s action, incorporating an anticipation of future changes.

A 0.5% rate hike can lead to:

- An immediate increase in mortgage rates, typically, though not always, less than the full 0.5%.

- Potential for lenders to reassess risk premiums, further influencing rates.

- Impact on adjustable-rate mortgages (ARMs), which are directly linked to benchmark rates.

It’s important to note that other factors also play a role, such as overall economic conditions, inflation expectations, and the demand for mortgage-backed securities. The speed and magnitude of the impact can thus vary.

In summary, a Federal Reserve interest rate hike generally leads to an immediate upward adjustment in mortgage rates, influenced by market expectations and lender behavior.

Effects on Different Types of Mortgages

A Federal Reserve rate hike can impact different types of mortgages distinctly. Understanding these nuances is crucial for prospective homebuyers and those considering refinancing.

Fixed-Rate Mortgages

Fixed-rate mortgages are the most common type. The interest rate remains constant throughout the loan term, providing predictability.

Adjustable-Rate Mortgages (ARMs)

ARMs have an initial fixed-rate period, after which the rate adjusts periodically based on a benchmark rate, such as the Secured Overnight Financing Rate (SOFR).

A Fed rate hike means:

- For fixed-rate mortgages, the impact is primarily on new loans. Existing mortgages remain unaffected.

- ARMs will see their rates adjust upward when the benchmark rate increases, leading to higher monthly payments.

- Borrowers with ARMs may consider refinancing into a fixed-rate mortgage to lock in a stable rate.

The Fed’s actions also influence interest rates on other mortgage products, such as those backed by the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). Changes in these rates can affect the affordability of homes for different borrower segments.

In conclusion, the type of mortgage a borrower has significantly determines how a Fed rate hike affects their borrowing costs. Understanding these differences is vital in mortgage planning.

Long-Term Implications for the Housing Market

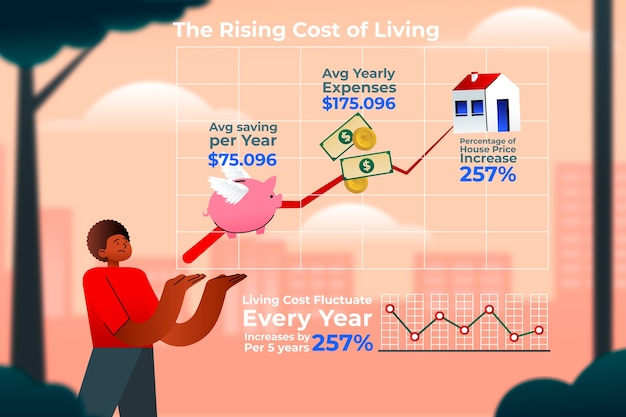

The Federal Reserve’s monetary policy decisions have long-lasting effects on the broader housing market. These influences extend beyond immediate rate adjustments, affecting affordability, demand, and home values.

Impact on Home Affordability

As mortgage rates rise, the cost of buying a home increases. This can reduce the number of potential homebuyers who can afford to enter the market.

Effects on Housing Demand

Higher rates typically cool down demand for homes. Some buyers may delay purchases or opt for more affordable properties.

- A decrease in demand can lead to a slowdown in price appreciation.

- In some cases, prices may decline, especially in markets with high inventory levels.

- Builders may scale back new construction projects in response to softening demand.

The broader economy also plays a role. If a rate hike leads to slower economic growth, it can further dampen the housing market. This effect is particularly pronounced if unemployment rises and consumer confidence falls.

In summary, the long-term implications of a Federal Reserve rate hike on the housing market can be significant, influencing affordability, demand, and overall market stability.

Strategies for Homebuyers and Homeowners

In an environment of rising interest rates, both prospective homebuyers and current homeowners need to develop strategies to make informed decisions. There are several steps that can be taken.

For Homebuyers

Homebuyers should carefully evaluate their budgets and consider the potential for future rate increases.

For Homeowners

Homeowners with adjustable-rate mortgages should assess their options for refinancing or converting to a fixed-rate loan.

Smart strategies include:

- Shopping around for the best mortgage rates from multiple lenders.

- Considering a smaller home or a different location to improve affordability.

- Paying down debt to improve credit scores and qualify for better rates.

It’s also essential to stay informed about the latest economic developments and seek advice from financial professionals. Understanding market trends and getting personalized advice can help individuals navigate the complexities of rising interest rates.

In review, strategies for homebuyers and homeowners in a rising interest rate environment involve careful budgeting, exploring refinancing options, and seeking professional advice.

Alternative Economic Factors to Consider

While the Federal Reserve’s interest rate decisions significantly impact mortgage rates, other economic factors also play a crucial role. Ignoring these factors can lead to an incomplete understanding of the mortgage market.

Inflation Expectations

Inflation expectations greatly influence long-term interest rates. If investors expect inflation to rise, they will demand higher yields on bonds, pushing mortgage rates up.

Economic Growth

The overall health of the economy affects interest rates. Strong economic growth can lead to higher rates, while a slowing economy may result in lower rates.

- The labor market’s strength influences wage growth and inflation.

- Consumer spending habits impact demand for goods and services.

- Geopolitical events can create uncertainty and volatility in financial markets.

Monitoring these indicators can provide additional insights into the direction of mortgage rates. A comprehensive view of the economic landscape is essential for making well-informed decisions in the mortgage market.

In essence, beyond the Fed’s actions, inflation expectations, economic growth, and global events all contribute to shaping mortgage rates.

| Key Aspect | Brief Description |

|---|---|

| 🏦 Fed Rate Hike | Increases borrowing costs, influencing mortgage rates. |

| 📈 Mortgage Rates | Rise following Fed actions, affecting affordability. |

| 🏠 Housing Market | Experiences shifts in demand and prices due to rate hikes. |

| 💡Planning Ahead | Requires careful budgeting and exploring refinancing options. |

Frequently Asked Questions

▼

A Fed rate hike does not directly affect your existing fixed-rate mortgage. Your interest rate and monthly payments will remain the same for the life of the loan, providing stability regardless of Fed actions.

▼

If you have an adjustable-rate mortgage, consider refinancing to a fixed-rate loan to lock in a stable interest rate. Evaluate the costs and benefits to determine if refinancing aligns with your financial goals.

▼

Mortgage rates generally respond quickly to a Fed rate hike, often within days or weeks. However, the exact timing and magnitude can depend on market conditions and lender behavior.

▼

Besides the Fed, mortgage rates are influenced by inflation expectations, economic growth, and global events. These factors can impact the overall demand for bonds and, consequently, mortgage rates.

▼

To prepare for potential increases, shop around for the best rates, improve your credit score, and carefully evaluate your budget. Consulting with a financial advisor can provide personalized guidance tailored to your situation.

Conclusion

Understanding the dynamics between Federal Reserve interest rate decisions and mortgage rates is invaluable for anyone involved in the housing market. By staying informed, strategizing effectively, and considering alternative economic factors, both homebuyers and homeowners can navigate the complexities and make sound financial choices during periods of rising interest rates.